The Double Triple Doji: Have We Been Warned?

By the end of the day, the bears had successfully brought the price of GE back to the day’s opening price. In Chart 3 above (doji B), the doji moved in the opposite direction from the movement shown in Chart 2. To cut a long story, a trading plan also ensures that you monitor your trading goals before you buy a foreign currency or sell it. Interestingly, leverage can be your best friend or your worst enemy. For instance, leverage enables you to carry out large-volume trades with comparatively lower amounts of capital. However, too much leverage, together with losses in trading, can make it difficult to repay the borrowed capital.

Technical analysis for binary options trading: a comprehensive guide – Zululand Observer

Technical analysis for binary options trading: a comprehensive guide.

Posted: Thu, 27 Jul 2023 14:05:59 GMT [source]

The size of the doji’s tail or wick coupled with the size of the confirmation candle can sometimes mean the entry point for a trade is a long way from the stop-loss location. A spinning top also signals weakness in the current trend, but not necessarily a reversal. It is not easy to gauge the potential rewards of the Doji candlestick.

Double Doji Candle [Three Main Pairs + Using Pattern]

It means that even though there were strong moves both up and down, neither buyers nor sellers could make any real progress. Spinning tops appear similarly to doji, where the open and close are relatively close to one another, but with larger bodies. In a doji, a candle’s real body will make up to 5% of the size of the entire candle’s range; any more than that, it becomes a spinning top. In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives.

This is a very simple strategy, yet one of the most reliable setup I’ve ever seen (and oh boy have I seen a lot of strategies in my Forex career…).

How to Spot a Double Doji Pattern

Therefore, all you need to do is find two consecutive candles with long wicks and small/non-existent bodies. The candlestick patterns are just the price action that shows the repetitive market behavior. We should understand the structure of those patterns to trade effectively. It would be best to learn to trade a single gravestone doji candlestick before using the double gravestone doji.

The patterns that form in the candlestick charts are signals of such market actions and reactions. The long-legged doji is a type of candlestick pattern that signals to traders a point of indecision about the future direction of a security’s price. This doji has long upper and lower shadows and roughly the same opening and closing prices.

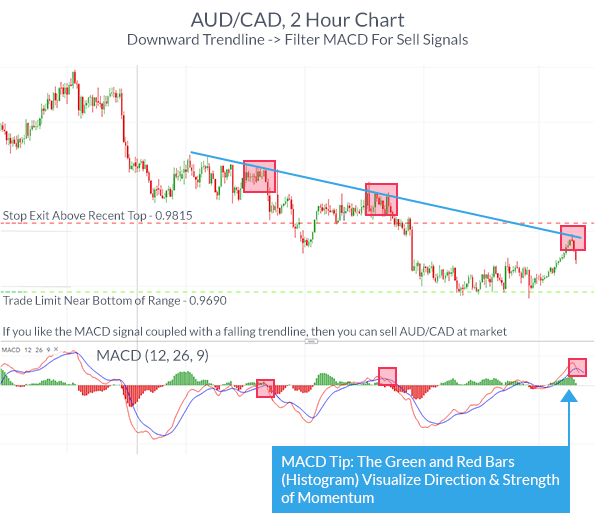

It is used to display the backtracking of a price downtrend and uptrend in the beginning. Double Doji is a very rare form of Doji candlestick and has the ability to find changes in comparison to a single Doji. In simple words, Doji tells traders that there are chances of a possible reversal or continuation trend. Keep in mind that the higher probability trades will be those that are taken in the direction of the longer-term trends. In case of an uptrend, the stop would go below the lower wick of the Doji and in a downtrend the stop would go above the upper wick.

Moreover, it is important to use other indicators before making any trading decisions. The neutral Doji (namely the common Doji) is the most commonly occurring Doji pattern. Neutral patterns indicate that buying and selling are almost the same and the future direction of the trend is uncertain.

Doji Dragonfly Candlestick: What It Is, What It Means, Examples

I share my knowledge with you for free to help you learn more about the crazy world of forex trading! The Double Doji can appear on any timeframe; however, the pattern can be prone to false signals on shorter timeframes. Price Data sourced from NSE feed, price updates are near real-time, unless indicated. Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary. In other words, buyers and sellers were engaged in a pretty even fight throughout the day until settling back down to where they started.

- It also depends mainly on the location of pattern formation on the chart.

- This potential bullish bias is further supported by the fact that the candle appears near trendline support and prices had previously bounced off this significant trendline.

- Ideally, the confirmation candle also has a strong price move and strong volume.

- Typically, an appearance of a double doji pattern signifies indecision and a potential trend reversal in either direction.

However, when the candle closes, there is hardly any difference between the open and close price. The Fisher_m11 on the other hand is a simple histogram indicator that isolates strength and the course of the trend and alerts changes in trend. This strategy with the help of the HMA_v2 and the Fisher_m11 custom indicator will capture the breakout. When we talk about the structure of the candle, a spinning top has a comparatively bigger body than Doji.

The Secret of the Double Doji

The formation of double Doji, along with price action, implies a substantial likelihood of a trend reversal or continuance. Counterattack lines are two-candle reversal patterns that appear on candlestick charts. For example, a gravestone or dragonfly Doji signals a trend reversal. However, the likelihood of the outcome increases when two consecutively forming candlesticks of the same type.

S&P 500’s Sell Signal, Nasdaq Edges Lower, Russell 2000 Bounces … – Investing.com

S&P 500’s Sell Signal, Nasdaq Edges Lower, Russell 2000 Bounces ….

Posted: Mon, 10 Jul 2023 07:00:00 GMT [source]

Candlestick charts are among the most famous ways to analyze the time series visually. They contain more information than a simple line chart and have more visual interpretability than bar charts. This article presents the Double Doji pattern and shows how to code a scanner in TradingView that detects it.

The pattern mentioned above shows that lower prices have been rejected. As a reminder, Dragonfly Doji shows a change in the price direction. Unfortunately, because prices were at all time highs in the chart above, there were no resistance levels to reference. However, on closer inspection, there were a few technical indicators that could have helped us instead.

It means they are now in a powerful position in comparison to sellers. The double Doji candle pattern is used when traders find a lot of doubts in the market and become confused. These patterns are helpful for them to handle the situation and fight against these hesitations. double doji pattern All the main features depend upon the environment of the market from where you start trading. It is a very simple trading strategy that controls the price movements in the market. This is similar to what happens in the market and portrayed by the Doji pattern.

Is a doji bullish or bearish?

Spinning tops are quite similar to doji, but their bodies are larger, where the open and close are relatively close. A candle’s body generally can represent up to 5% of the size of the entire candle’s range to be classified as a doji. In Japanese, “doji” (どうじ/ 同事) means “the same thing,” a reference to the rarity of having the open and close price for a security be exactly the same. Depending on where the open/close line falls, a doji can be described as a gravestone, long-legged, or dragonfly, as shown below. Let’s say I determined the Stop Loss to be 50 pips, thus the first target would be 25 pips.

- Keep in mind that the higher probability trades will be those that are taken in the direction of the longer-term trends.

- The filled or hollow bar created by the candlestick pattern is called the body.

- Whereas Doji cand long-legged doji indicates a pause in the trend and ranging market structure.

- However, the morning rally did not last long before the bears took over.

- Unfortunately, because prices were at all time highs in the chart above, there were no resistance levels to reference.

The Doji represents an arm wrestling fight between buyers and sellers, until one of the sides puts down enough force to win. The meaning is that the opening and closing price of the candle are the same. For example if you’re looking at a „1 hour” (H1) chart, each candle represents one hour of market activity.

If we just look at the Doji candlestick, we can understand that there is hardly any difference between the opening and closing prices. This also means that both buyers and sellers have failed to create significant price movements. Traders look at the historical price behavior that adds up to the Doji to understand the significance of this candlestick. Technical experts believe that the price reflects all available information about the crypto asset, showing that the price is efficient. However, previous price performance does not predict future price performance, and a crypto current price may not reflect its actual or intrinsic worth.